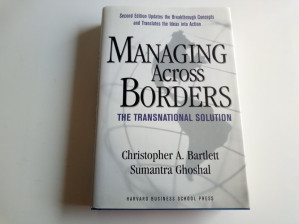

Managing Across Borders Second Edition 🔍

CHRISTOPHER A.BARTLETT,SUMANTRA GHOSHAL,President and Fellows of Harvard College, Christopher A. Bartlett and Sumantra Ghoshal, Bartlett, Christopher A., Ghoshal, Sumantra, Christopher A Bartlett, Sumantra Ghoshal

Harvard Business School Press, 1998, 1998

英语 [en] · PDF · 98.0MB · 1998 · 📗 未知类型的图书 · 🚀/duxiu/zlibzh · Save

描述

With Deregulation, Privatization, And Information Technology Transforming Competition, The Transnational Model Continually Evolves. In A Timely Response To This Dynamically Changing Business World, Bartlett And Ghoshal Revisit Their Breakthrough Concepts, Updating The Material With Fresh Examples Drawn From Today's Leading Global Enterprises. The Second Edition Of Managing Across Borders Builds On The Authors' Ongoing Exploration Of The Transnational, With Their Current Research Extending And Illuminating The Findings Of Their Earlier Work. An Entirely New Section, The Transformation Challenge, Focuses On How Several Companies Have Implemented The Book's Concepts. We See Firsthand The Obstacles And Opportunities To Building An Effective Transnational Organization. This New Edition Also Includes An Application Handbook, A Highly Practical Tool That Helps Readers Translate The Book's Ideas Into Real-world Action Plans For Their Companies.--jacket. Pt. I. The Transnational Challenge. Organizational Capability : The Next Battleground -- New Organizational Challenge : Beyond Structural Fit -- Administrative Heritage : Organizational Asset And Constraint -- The Transnational : The Emerging Organization Model -- Pt. Ii. Characteristics Of The Transnational. Building Competitiveness : The Integrated Network -- Developing Flexibility : Specialized Roles And Responsibilities -- Facilitating Learning : Multiple Innovation Processes -- Pt. Iii. Building And Managing The Transnational. Legitimizing Diversity : Balancing Multiple Perspectives -- Managing Complexity : Developing Flexible Coordination -- Building Commitment : Creating A Matrix In Managers' Minds -- Pt. Iv. Transformation To The Transnational. Developing Transnational Managers : New Roles And Tasks -- Managing The Transformation Process : Rationalization, Revitalization, Regeneration -- The Transnational Solution. Christopher A. Bartlett And Sumantra Ghoshal. Includes Bibliographical References (p. 367-379) And Index.

备用文件名

duxiu/initial_release/《Managing-Across-Borders-Second-Edition》_40457389.zip

备用文件名

zlibzh/no-category/CHRISTOPHER A.BARTLETT,SUMANTRA GHOSHAL,President and Fellows of Harvard College, Christopher A. Bartlett and Sumantra Ghoshal, Bartlett, Christopher A., Ghoshal, Sumantra, Christopher A Bartlett, Sumantra Ghoshal/Managing Across Borders Second Edition_116958132.pdf

备选标题

Managing Across Borders: The Transnational Solution, 2nd Edition

备用出版商

Harvard Business Review Press

备用出版商

Ebsco Publishing

备用出版商

H B S New Media

备用版本

Harvard Business School Press, Boston, Mass, 1998

备用版本

2nd ed., Boston, Mass, Massachusetts, 1998

备用版本

2nd ed., Boston, Mass, United States, 2002

备用版本

United States, United States of America

备用版本

2. ed., [Nachdr, Boston, Mass, 2007

备用版本

2nd ed, Boston (Mass.), cop. 1998

备用版本

2 edition, February 4, 2002

备用版本

Second Edition, 1998

备用版本

Second, PS, 2002

元数据中的注释

related_files:

filepath:《Managing-Across-Borders-Second-Edition》_40457389.zip — md5:ae5490a54860abeb1b88140841005b8b — filesize:82075545

filepath:《Managing-Across-Borders-Second-Edition》_40457389.zip — md5:10f0a53d921a6acd9b5405609e7d785f — filesize:82075545

filepath:20b/贵州财经大学Ga【001-030】15000本更新/01-001/《Managing-Across-Borders-Second-Edition》_40457389.zip

filepath:40457389.zip — md5:264d1d9a008bf4e3de4993c158ea09c8 — filesize:82042785

filepath:40457389.zip — md5:c7bed705098cd9af0b705e2ee7f58261 — filesize:82042785

filepath:40457389.zip — md5:4943ee8c2nff5d4a40231eec9223d9e7 — filesize:82075545

filepath:/读秀/读秀4.0/读秀/4.0/数据库21-1/40457389.zip

filepath:第二部分/85-1/40457389.zip

filepath:《Managing-Across-Borders-Second-Edition》_40457389.zip — md5:ae5490a54860abeb1b88140841005b8b — filesize:82075545

filepath:《Managing-Across-Borders-Second-Edition》_40457389.zip — md5:10f0a53d921a6acd9b5405609e7d785f — filesize:82075545

filepath:20b/贵州财经大学Ga【001-030】15000本更新/01-001/《Managing-Across-Borders-Second-Edition》_40457389.zip

filepath:40457389.zip — md5:264d1d9a008bf4e3de4993c158ea09c8 — filesize:82042785

filepath:40457389.zip — md5:c7bed705098cd9af0b705e2ee7f58261 — filesize:82042785

filepath:40457389.zip — md5:4943ee8c2nff5d4a40231eec9223d9e7 — filesize:82075545

filepath:/读秀/读秀4.0/读秀/4.0/数据库21-1/40457389.zip

filepath:第二部分/85-1/40457389.zip

元数据中的注释

Includes bibliographical references (p. 367-379) and index.

备用描述

<h3>Excerpt</h3> <div><p><br> <p><font size="+2"> Chapter One </font> <p><br> <p><blockquote> <b>Organizational<br> Capability:<br> The<br> Next<br> Battleground</b></blockquote> <p><br> <p>The world's largest companies are in flux. New pressures have transformed the global competitive game, forcing these companies to rethink their traditional worldwide strategic approaches. The new strategies, in turn, have raised questions about the adequacy of organizational structures and processes used to manage worldwide operations. <p> Even within particular industries, worldwide companies have developed very different strategic and organizational responses to changes in their environment. While a few players have prospered by turning the environmental turmoil to their advantage, many more are merely survivingstruggling to adjust to complex, often contradictory demands. Some large well-established worldwide companies have been forced to take large losses or even to abandon businesses. <p> Our research has explored some provocative questions raised by the diverse experience of worldwide companies. <p><br> <p><blockquote> How could Matsushita evolve in just two decades from a medium-size manufacturer of electrical products for the Japanese domestic market to a $20 billion global company, the undisputed leader in the consumer electronics industry? Of the companies it overtook, why has Philips found it so difficult to adjust to the industry changes? Yet how has it survived while General Electric was eventually forced to sell off its consumer electronics business?</blockquote> <p><br> <p><blockquote> In branded packaged products like soaps and detergents, how has Unilever defended its dominant world position for more than half a century? How was Procter & Gamble (P&G) able to mount a major thrust into international markets in the postwar era? And why has the internationalization thrust of Kao, the dominant Japanese competitor in this industry, been stalled in the developing countries of East Asia, despite Kao's formidable technological capabilities, its highly efficient plants, and its demonstrated marketing muscle?</blockquote> <p><br> <p><blockquote> How has Sweden's Ericsson enhanced its position as a leader in the dynamic telecommunications switching business? What is behind NEC's gains in this highly competitive global industry? Why was ITT, the most international of all telecommunications companies and second only to AT&T in size, forced to abandon its planned entry into the U.S. switching market, and then to sell its formidable European telecommunication business?</blockquote> <p><br> <p> The disappointments and failures some of those companies have encountered in their international operations were not due primarily to inappropriate strategic analysis, but to organizational deficiencies. Throughout our five-year study, we were continually impressed by the fact that most managers of worldwide companies recognized <i>what</i> they had to do to enhance their global competitiveness. The challenge was <i>how</i> to develop the organizational capability to do it. <p><br> <p><b>The Laggards and Losers</b> <p><br> <p>Very few worldwide companies entered the 1980s with the kind of organization that could respond effectively to the changed business environment. During the course of our study, we saw traditional industry characteristics disrupted and reconfigured, and companies forced to modify their once effective organizational structures and relationships. But some companies found it particularly difficult to respond to the new pressures. The problems faced by GE, Kao, and ITT illustrate the new challenges a worldwide corporation now confronts. <p><br> <p><b>Lost Competitiveness: The Case of GE</b> <p><br> <p>For General Electric, heir to Thomas Edison's innovative genius and one of the most admired companies-in the world, a leading role in the global consumer electronics industry was once a cherished dream and a reasonable expectation. GE possessed the most advanced technological capabilities in the field, and its dominance in the electrical appliances industry provided a base on which to build a similar position in a related area. Yet, after decades of investment and effort, GE conceded defeat to the Japanese challenge and withdrew from the business. <p> GE's philosophy of internationalization was to build mini-GEs in each country that could draw on the vast technological and managerial resources of the parent company to internationalize successful American technologies and products. For some time, this strategy served GE's consumer electronics business well, and by the late 1960s the company had built strong, if somewhat scattered, positions in many national markets, particularly in Canada and in Central and South America. <p> By the early 1970s, as the Japanese challenge in radios and television sets intensified, GE saw that global competitiveness would require greater integration of its diverse worldwide operations. But an organizational mentality that considered foreign subsidiaries as appendages to a dominant domestic operation kept the company from recognizing the urgency of this strategic task. In the late 1970s, the Japanese threat finally forced GE to take stronger actions. Its "World Iron Project" was conceived as a pilot program for global integration. The project demonstrated that GE could achieve efficiencies through product and process innovations (redesign eliminated 40 percent of parts in a standard iron, and process changes reduced direct labor hours by 25 percent) and a massive shift in sourcing patterns (developing global-scale plants in Singapore, Mexico, and Brazil). But it was too little and too late. The Japanese competitors had already developed insurmountable leads, and GE's competitive position in many of its consumer products had been eroded beyond repair. The company's consumer electronics business withdrew to its home market, and in 1987 was sold to Thomson, a French company. <p><br> <p><b>Forces for Global Integration: Need for Efficiency.</b> GE's failure illustrates a problem that plagued American and European companies in a wide range of industries: the lack of <i>global efficiency</i>. According to Theodore Levitt, technological, social, and economic developments over the last two decades have combined to create a unified world marketplace in which companies must capture global-scale economies to remain competitive. While Levitt's arguments are somewhat extreme and one-sided, he provides an insightful analysis of some of the forces of change that have recently reshaped markets around the world. <p> In some industries, a major technological innovation forced a fundamental realignment of industry economics and allowed companies to develop and manufacture products on a global basis, thereby taking advantage of the convergence of consumer preferences and needs worldwide. A classic example is the impact of transistors and integrated circuits on the design and production of such products as radios, television, and tape recorders. Similarly, the introduction of quartz technology made watchmaking a scale-intensive global industry. <p> Even in industries that lacked such strong external forces of change, managers began to look for ways to achieve global economies. They rationalized their product lines, standardized parts design, and specialized their manufacturing operations. Such internal restructuring triggered a second wave of globalization in industries as diverse as automobiles, office equipment, industrial bearings, construction equipment, and machine tools. <p> More recently, even some companies in classically local businesses have begun to examine the opportunities for capturing economies beyond their national borders. In Europe, where the branded packaged goods industry has traditionally responded to national differences in consumer tastes and market structures, companies are now achieving substantial scale economies by restructuring and specializing their plant configurationseven though that means standardizing product formulations, rationalizing pack sizes, and printing multilingual labels. <p> Economics was not the only force driving companies to integrate their operations globally in this period. Consumer tastes and preferences, which once differed widely from one national market to the next, began homogenizing. Again, this influence has spread from businesses in which the worldwide standardization of products was relatively easy (watches, calculators, and cameras, for example) to others in which consumers' preferences and habits were only slowly converging. Again, major external discontinuities greatly facilitated the change. The oil shocks of the 1970s, for example, triggered a worldwide demand for smaller, more fuel-efficient automobiles. In some markets companies acted to influence changes in consumer preferences. Food tastes and eating habits were long thought to be the most culture bound of all consumer behaviors. Yet, as companies like Kellogg, McDonald's, and Coca-Cola have shown, in Eastern and Western countries alike, even these culturally linked preferences can be changed. <p> Thus, the forces driving companies to integrate their operations worldwide spread from industries where external structural change or discontinuity dictated a global strategy to industries in which managers had to create the opportunity for global economies. A further force for globalization was a competitive strategy sometimes called "global chess." The game could only be played by companies managing their worldwide operations as interdependent units guided by a coordinated global strategy. Whereas the traditional multinational approach assumed that each national market was unique and independent of others, this strategy emphasized the effect of financial interdependence. Regardless of consumer tastes or manufacturing scale economies, the corporation with worldwide operations was advantaged because it could use funds generated in one market to subsidize its position in another. <p> In industry after industry, companies that operated their local companies as independent profit centers found themselves at a disadvantage to competitors playing global chess. Companies that found no economic, technological, or market reason to manage their businesses globally suddenly needed to do so for reasons of competitive strategy. <p> Thus, for a variety of reasons and in an ever-expanding number of industries, companies are being forced to manage their businesses in a more globally integrated manner in order to capture the benefits of efficiency. Some companies, like GE's consumer electronics business, were eventually overwhelmed by the challenge. Others, like Matsushita, found their principal source of competitive advantage in their ability to build an organization able to respond to these new demands. <p><br> <p><b>Stalled Internationalization: The Case of Kao</b> <p><br> <p>Kao, Japan's leading producer of soaps, detergents, and personal care products, is both admired and feared by Procter & Gamble and Unilever as a potential global competitor. It has all the key elements of the Japanese juggernaut: a highly efficient centralized production system, an extremely strong position in its large home base, and a sophisticated process technology that has been gradually expanded through an extensive overseas licensing program. Acclaimed as one of the top ten in the ranks of "excellent" Japanese companies, Kao has continuously strengthened its position within Japan not only at the cost of other domestic competitors, but also by beating down the challenges of foreign competitors such as Procter & Gamble. For example, P&G was the first to introduce disposable diapers to the Japanese market and had developed a commanding 80 percent market share. Kao, a latecomer to this product category, combined an innovation blitz with high-quality production to capture over 30 percent of the market. This effort, combined with two other local companies' disposable diaper launches, reduced P&G, at one point, to a low 8 percent share. <p> Kao has shown the same strategic commitment to globalization as many other Japanese companies. It first built up its offshore business in East Asian countries like Indonesia, Malaysia, Singapore, the Philippines, Thailand, and Hong Kong. Using this base to develop manufacturing scale and production technology, the company then attempted to enter the advanced markets in the United States and Europe. But, despite significant investments over several decades and a reputation for supplying high-quality technologically advanced products at relatively low cost, by the late 1980s Kao was still not a significant global player. <p> Historically Kao considered its foreign subsidiaries primarily as delivery pipelines for the company's standardized products and services. As a result, the entire system depended on strong headquarters functional capabilities. This organizational form worked well in small neighboring Asian markets, where market development and product technology often lagged behind Japan's, but represented a major impediment as the company approached the large sophisticated markets of Europe and North America. <p> In these markets, Kao found very different customer characteristics, habits, and expectations. For example, shampoo, deodorant, and bath soap developed for the Japanese did not always suit Western customer profiles. Neither did detergents developed for very different laundry practices in Japan. Product technologies that represented major advances in some Asian markets were often either commonplace or inappropriate in Europe and the United States. Furthermore, in channels of distribution, advertising media, and other aspects of the marketing infrastructure, these markets were highly sophisticated and quite different from those in which the company operated in Asia. <p> Kao's fundamental problem was not inappropriate products or marketing strategies, but its inability to understand the differences between markets and adapt appropriately. In the 1970s, it acquired industrial chemical companies in Spain and Mexico, and entered joint ventures with Colgate in the United States and Beyersdorf in Europe. But these steps did not provide the local sensitivity and market understanding the company needed, or the entrepreneurial capability to convert such understanding into appropriate product-market strategies. <p><br> <p><b>Force for Local Differentiation: Need for Responsiveness.</b> The fact that Kao's lack of <i>national responsiveness</i> to local needs has so far frustrated the company's efforts to build a global reach illustrates the limitations of Levitt's argument that "the world's needs and desires have been irrevocably homogenized" and that "the commonality of preferences leads inescapably to the standardization of products, manufacturing, and the institution of trade and commerce." While these may indeed be long-term trends in many industries, there are important short- and medium-term impediments and countertrends that must be considered if companies are to operate successfully over the next decade, or two, or three, as the international economy jolts along<i>perhaps</i> eventually toward Levitt's "global village." <p> Barriers and countertrends such as those experienced by Kao have forced managers of worldwide companies to be more sensitive to national differences and local interests in the host countries where they operate. By the late 1970s, the impact of localizing forces was being felt with increasing urgency, particularly by many Japanese companies. Indeed, if the strategic implications of globalization have dominated management thinking in the West, localization has become the preoccupation of top-level executives in Japan. <p> The classic barrier to globalization has always been rooted in the differences in national market structures and consumer preferences. Clearly, as Levitt argues, international travel and communications have reduced those differences, yet worldwide tastes, habits, and preferences are far from homogeneous. <p> </div><br/> <i>(Continues...)</i> <!-- Copyright Notice --> <div><blockquote><hr noshade size="1"><font size="-2">Excerpted from <b>Managing Across Borders</b> by <b>Bartlett Christopher A., Ghoshal Sumantra</b>. Copyright © 1998 by Bartlett Christopher A.. Excerpted by permission of Harvard Business School Press.<br/>All rights reserved. No part of this excerpt may be reproduced or reprinted without permission in writing from the publisher.<br/>Excerpts are provided by Dial-A-Book Inc. solely for the personal use of visitors to this web site.</font><hr noshade size="1"></blockquote></div>

备用描述

Widely acclaimed for its perceptive insights into the management of companies operating in an international environment, "Managing Across Borders" has established itself as a landmark book. Bartlett and Ghoshal describe the emergence of a revolutionary corporate form - the transnational - and reveal how the nature of the global competitive game has fundamentally changed."Highly readable! Valuable lessons for companies in a wide range of industries and sizes-indeed, almost any organization operating several different businesses across borders." - "The Financial Times". "A fascinating book! The conclusions certainly break away from the perceived wisdom about the factors needed for success in global markets." - "Management Today". ""Managing Across Borders" makes clear that success in global strategy is as much a function of the ability to organize and manage as it is the ability to create a sound strategy. Bartlett and Ghoshal make an important and highly practical contribution in a book that represents the leading edge of thinking on this important subject." - Michael E.Porter, Bishop William Lawrence University Professor, Harvard Business School, and author of "Competitive Strategy".

开源日期

2024-06-13

🚀 快速下载

成为会员以支持书籍、论文等的长期保存。为了感谢您对我们的支持,您将获得高速下载权益。❤️

🐢 低速下载

由可信的合作方提供。 更多信息请参见常见问题解答。 (可能需要验证浏览器——无限次下载!)

- 低速服务器(合作方提供) #1 (稍快但需要排队)

- 低速服务器(合作方提供) #2 (稍快但需要排队)

- 低速服务器(合作方提供) #3 (稍快但需要排队)

- 低速服务器(合作方提供) #4 (稍快但需要排队)

- 低速服务器(合作方提供) #5 (无需排队,但可能非常慢)

- 低速服务器(合作方提供) #6 (无需排队,但可能非常慢)

- 低速服务器(合作方提供) #7 (无需排队,但可能非常慢)

- 低速服务器(合作方提供) #8 (无需排队,但可能非常慢)

- 低速服务器(合作方提供) #9 (无需排队,但可能非常慢)

- 下载后: 在我们的查看器中打开

所有选项下载的文件都相同,应该可以安全使用。即使这样,从互联网下载文件时始终要小心。例如,确保您的设备更新及时。

外部下载

-

对于大文件,我们建议使用下载管理器以防止中断。

推荐的下载管理器:JDownloader -

您将需要一个电子书或 PDF 阅读器来打开文件,具体取决于文件格式。

推荐的电子书阅读器:Anna的档案在线查看器、ReadEra和Calibre -

使用在线工具进行格式转换。

推荐的转换工具:CloudConvert和PrintFriendly -

您可以将 PDF 和 EPUB 文件发送到您的 Kindle 或 Kobo 电子阅读器。

推荐的工具:亚马逊的“发送到 Kindle”和djazz 的“发送到 Kobo/Kindle” -

支持作者和图书馆

✍️ 如果您喜欢这个并且能够负担得起,请考虑购买原版,或直接支持作者。

📚 如果您当地的图书馆有这本书,请考虑在那里免费借阅。

下面的文字仅以英文继续。

总下载量:

“文件的MD5”是根据文件内容计算出的哈希值,并且基于该内容具有相当的唯一性。我们这里索引的所有影子图书馆都主要使用MD5来标识文件。

一个文件可能会出现在多个影子图书馆中。有关我们编译的各种数据集的信息,请参见数据集页面。

有关此文件的详细信息,请查看其JSON 文件。 Live/debug JSON version. Live/debug page.